The European Union's recent decision to impose tariffs of up to 38% on Chinese electric vehicles (EVs) has sparked a heated debate across global markets. While Brussels frames the move as a necessary defense against unfair competition, Beijing condemns it as blatant protectionism. The reality, however, may lie somewhere in between—a complex interplay of economic survival, geopolitical posturing, and genuine concerns about market distortion.

A Calculated Strike or Desperate Measure?

The EU's provisional tariffs, announced after a seven-month anti-subsidy investigation, target what officials describe as China's "unfair" state support for its EV industry. European Commission President Ursula von der Leyen has repeatedly emphasized that Europe welcomes competition but not what she calls "a race to the bottom." The tariffs—ranging from 17.4% to 38.1% depending on the manufacturer—come atop the existing 10% duty, potentially making Chinese EVs prohibitively expensive in European markets.

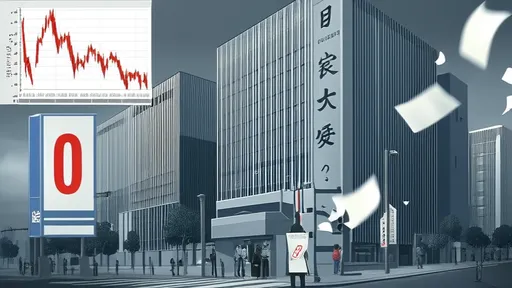

Behind the technical jargon of trade remedies lies a deeper anxiety. European automakers, particularly in Germany and France, have watched with growing alarm as Chinese EV exports surged by 85% last year. BYD, Geely, and SAIC's MG now account for nearly 10% of Europe's EV sales, with projections suggesting this could double by 2025. The speed of this market penetration has triggered existential fears in an industry that employs over 13 million Europeans.

The Subsidy Question

China's EV sector undeniably benefited from substantial government support during its formative years. Between 2009 and 2022, direct subsidies totaled approximately $29 billion, with additional incentives like tax exemptions and preferential loans. However, these supports have been gradually phased out—the national purchase subsidy program ended in 2022—raising questions about whether the EU's action comes too late to address what is now a mature, competitive industry.

European investigators point to more subtle forms of ongoing support: cheap land allocations, state-backed raw material supplies, and provincial-level incentives. A 200-page EU report alleges that BYD received €2.1 billion in "green" subsidies from Shenzhen authorities, while SAIC benefited from Shanghai government research grants. Chinese officials counter that European automakers have similarly benefited from decades of government support, including recent pandemic recovery funds and battery development subsidies.

The German Dilemma

Berlin's ambivalent reaction reveals the policy's internal contradictions. While France strongly backed the tariffs, Germany—whose automakers sold 40% of their China-made vehicles in the Chinese market last year—warned of potential retaliation. Volkswagen CEO Oliver Blume publicly opposed the measures, noting that "protectionism risks starting a spiral of tariffs." This division underscores how Europe's largest economy balances between protecting its industrial base and preserving access to the world's biggest auto market.

The timing couldn't be more delicate. German automakers are struggling with their EV transition—Volkswagen recently cut its profit forecast due to weaker-than-expected electric car demand. Meanwhile, Chinese manufacturers are rapidly closing the technology gap, with BYD's Blade battery and NIO's battery-swapping stations gaining international recognition. The EU tariffs may provide temporary breathing space but won't address the underlying competitiveness challenges.

Global Ripple Effects

Beyond Europe, the decision amplifies a growing global divide in green technology trade. The United States maintains 27.5% tariffs on Chinese EVs, while Turkey recently imposed 40% additional duties. China, for its part, has launched an anti-dumping investigation into European pork products—a targeted response hitting key EU exporters like Spain and Denmark. This tit-for-tat dynamic threatens to fragment the very global supply chains needed to achieve climate goals.

Developing nations are watching nervously. Countries like Hungary and Serbia, where Chinese EV manufacturers have established production hubs, fear becoming collateral damage. BYD's new Hungarian factory and Great Wall Motor's Thai plant represent attempts to circumvent tariffs, but these investments now face uncertainty. The risk is a bifurcated market where only the wealthiest nations can afford premium-priced "local" EVs, while others remain dependent on older combustion technology.

Innovation vs. Protection

History suggests that protectionism rarely nurtures long-term competitiveness. The U.S. steel tariffs of 2002, intended to revive domestic producers, ultimately cost more jobs than they saved. Conversely, when Japan's auto industry faced protectionist measures in the 1980s, it responded by establishing local production—a strategy Chinese firms are now replicating. The EU's challenge is to support its industry without insulating it from the competitive pressures that drive innovation.

Some analysts argue Europe would do better accelerating its own industrial transformation. The continent lags in battery production capacity and raw material refining—key components where China commands 60-80% of global supply. The EU's Critical Raw Materials Act and Net-Zero Industry Act aim to address these gaps, but progress has been slow. Without parallel investments in next-generation battery technology and charging infrastructure, tariffs alone won't secure Europe's automotive future.

The Climate Imperative

Beneath the trade dispute lies an uncomfortable truth: the world needs more affordable EVs, not fewer. Transport accounts for 25% of EU emissions, and the bloc has pledged to phase out combustion engines by 2035. Chinese EVs, often priced 20-30% below European equivalents, have been crucial to democratizing access. The tariffs risk slowing adoption rates at precisely the moment acceleration is needed.

European environmental groups have expressed concern that the measures could backfire. "We're in a climate emergency," says Julia Poliscanova of Transport & Environment. "Instead of shutting out affordable clean vehicles, Europe should focus on matching China's pace of innovation." Some suggest compromise measures, such as tariff exemptions for truly budget models or technology-sharing requirements, but these ideas have gained little traction.

As the EU prepares to finalize the tariffs by November, all eyes are on negotiation channels. Both sides have strong incentives to avoid a full-blown trade war—China needs European markets to absorb its production overcapacity, while Europe relies on Chinese battery materials and components. The coming months will test whether economic pragmatism can prevail over political posturing in this high-stakes confrontation between the world's two largest trading blocs.

By /Jun 23, 2025

By /Jun 23, 2025

By /Jun 23, 2025

By /Jun 23, 2025

By /Jun 23, 2025

By /Jun 23, 2025

By /Jun 23, 2025

By /Jun 23, 2025

By /Jun 23, 2025

By /Jun 23, 2025

By /Jun 23, 2025

By /Jun 23, 2025

By /Jun 23, 2025

By /Jun 23, 2025

By /Jun 23, 2025

By /Jun 3, 2025

By /Jun 3, 2025